Computers are an integral part of daily life, and when they malfunction, it can disrupt productivity and personal tasks. PC repair involves diagnosing and resolving hardware and software issues to restore functionality. Whether you’re dealing with a slow computer, overheating issues, or malware infections, knowing how to troubleshoot can save time and money.

Common PC Issues and How to Fix Them

1. Slow Performance

A sluggish PC can result from outdated software, too many background processes, or insufficient memory.

- Fix:

- Close unnecessary programs

- Upgrade RAM if needed

- Clear temporary files using Disk Cleanup

- Run antivirus scans to check for malware

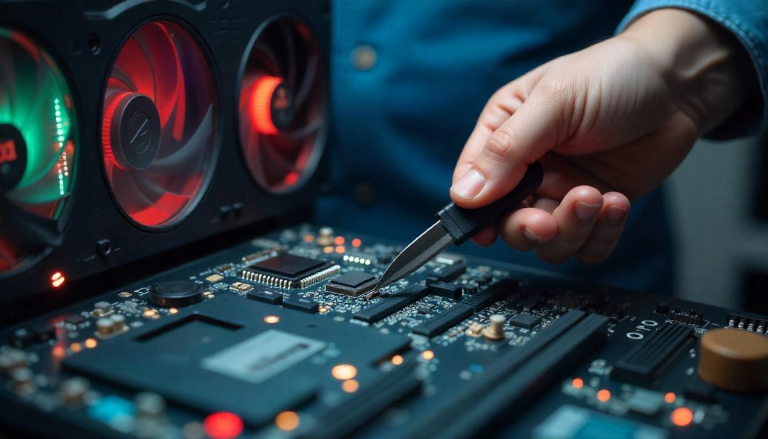

2. Overheating and Cooling Problems

Overheating can damage internal components and cause unexpected shutdowns.

- Fix:

- Clean dust from fans and vents

- Apply new thermal paste to the CPU

- Ensure proper airflow in the system

- Use cooling pads for laptops

3. Blue Screen of Death (BSOD)

A BSOD usually indicates serious system errors related to hardware or drivers.

- Fix:

- Update drivers and Windows OS

- Check RAM for faults using Windows Memory Diagnostic

- Scan for corrupted system files with

sfc /scannow - If recent changes caused the issue, perform a system restore

4. Internet Connectivity Problems

Connectivity issues can arise due to router malfunctions, driver problems, or ISP outages.

- Fix:

- Restart the router and modem

- Update network drivers

- Run Windows Network Troubleshooter

- Reset TCP/IP settings using Command Prompt

5. Software Crashes and Freezing

Unstable software can lead to frequent crashes and system hangs.

- Fix:

- Reinstall or update problematic software

- Check for Windows updates

- Run

chkdsk /fto scan for disk errors - Disable unnecessary startup programs

PC Maintenance Best Practices

1. Regular Software Updates

Keep Windows, drivers, and installed programs up to date to prevent security vulnerabilities.

2. Routine Disk Cleanup and Defragmentation

- Use built-in tools like Disk Cleanup and Defragment and Optimize Drives to maintain disk health.

3. Backup Important Data

- Regularly backup files using external drives or cloud services like Google Drive or OneDrive.

4. Protect Against Malware

- Install a reputable antivirus program and enable real-time protection.

- Avoid downloading files from unknown sources.

5. Proper Hardware Care

- Keep your PC clean and free of dust.

- Ensure cables and peripherals are securely connected.

When to Seek Professional Help

Some PC issues require professional assistance, including:

- Hardware failures (e.g., motherboard, GPU, or power supply issues)

- Persistent BSOD errors despite troubleshooting

- Data recovery after accidental deletion or corruption

- Severe malware infections that antivirus tools cannot remove

Professional repair services can provide diagnostics, hardware replacements, and advanced troubleshooting.

Conclusion

Knowing how to diagnose and repair common PC issues helps extend the lifespan of your computer and maintain its performance. By following regular maintenance best practices, you can prevent problems before they arise. For complex issues, professional repair services can ensure your system runs efficiently and securely.

By keeping your PC optimized and secure, you can enjoy a seamless computing experience for years to come.